Real estate syndication is not a REIT – it is a way of investing in specific, tangible real estate through a crowdfunding model. A group of investors pools their money in a large real estate investment they couldn’t afford to acquire individually. Management of the investment is the responsibility of the real estate syndication company. This allows investors to profit from passive real estate income without the hassle of managing the property or tenants. The investors benefit from a predictable cash flow and are not subject to stock market volatility.

First, let’s define what a real estate syndication is. When a real estate investment company organizes a group of individual investors to purchase a property, it’s called a syndication. This type of investment is very attractive to individuals, family offices, trusts, and other investors who do not wish to be the sole owners of a large property. Syndication allows an individual investor to take a passive role in the property investment and avoid the headaches of managing the property.

In exchange, each investor receives a percentage of cash flow on a quarterly basis, and a share of the profits when the property is sold.

A real estate syndication differs from a real estate investment fund: with a syndication you’re investing in a specific property; with a fund, you’re investing in the many assets of a real estate company.

Besides receiving passive income, the benefit to the investor is they don’t need to be an expert in real estate investing or property management, they have limited liability, and they can invest in multiple properties.

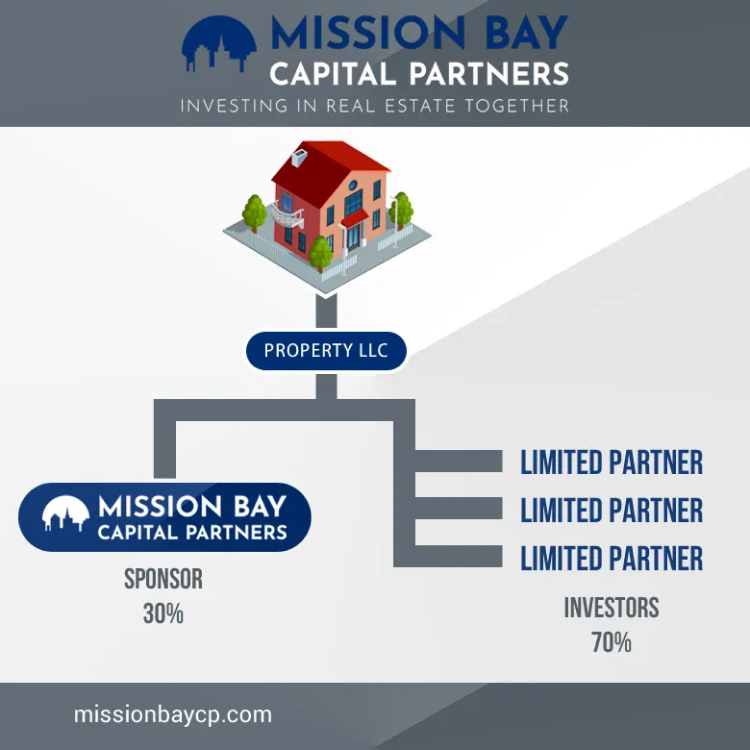

There are 2 roles in real estate syndication: the syndicator (also known as the sponsor or operator) and the investors.

The role of the sponsor is to find the investment property and determine if it’s a sound investment with the possibility of substantial returns. The sponsor’s day-to-day experience with property investment and management allows them to identify valuable opportunities. To determine the viability of the investment, they may do an onsite visit, check property records, check bank statements, examine bookkeeping records of the current owners, check local zoning laws, analyze local market volatility, how the property’s occupancy rate compares to others in the market, a rent roll (list of the property’s tenants and how much rent they pay), and a number of other factors.

If the sponsor decides to move forward with a syndication, they create an offering document for the property, organize a group of investors, acquire the property, manage the property, and disburse quarterly profits and sale profits to investors. The sponsor is also responsible for deciding on the most favorable time to sell the property.

The role of the individual investor is to place their investment with the sponsor for a specific property and then do little else. The investor makes passive income from the property – they receive quarterly distributions and their share of the profits and have no input on the day-to-day operations.

Who can invest?

Those who have an income of at least $200,000 individually or $300,000 jointly for each of the past 2 years, or who individually or jointly have a net worth of at least $1 Million, excluding their primary residence.

Those who have some knowledge and experience in financial and business matters and are capable of evaluating the merits and risks of an investment.

Enter Your Information to Get Your FREE Multi-Family Real Estate Investment Guide